International supply chains and drug shortages: Why dependence on foreign manufacturing is risking medicine access

Feb, 11 2026

Feb, 11 2026

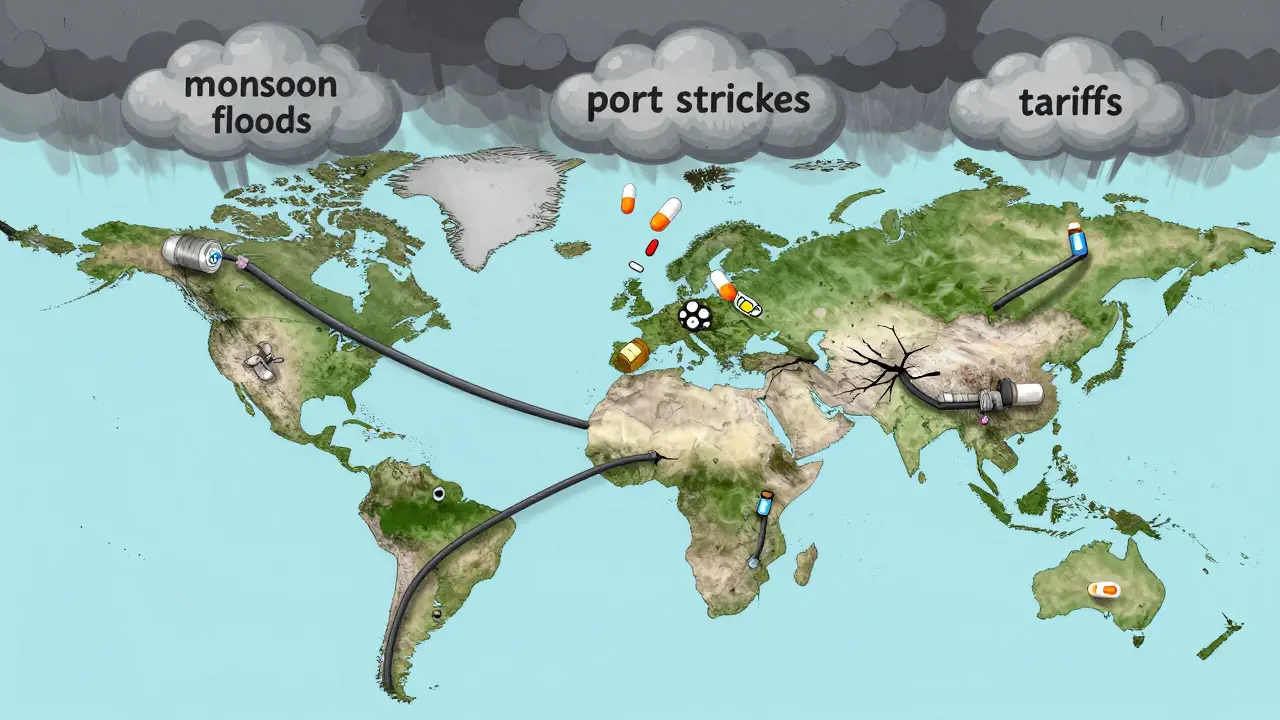

When you pick up a prescription for antibiotics, insulin, or even a simple painkiller, chances are it didn’t start in your country. In fact, foreign manufacturing now controls over 80% of the active ingredients in medicines used across the U.S., Canada, and Europe. This isn’t just a footnote in global trade-it’s a silent crisis that’s already causing real drug shortages, delayed treatments, and life-threatening gaps in care.

It sounds simple: make drugs where it’s cheapest. But that logic has cracked under pressure. Between 2020 and 2025, over 150 critical medicines saw repeated shortages in North America and New Zealand. Some were antibiotics. Others were cancer drugs. A few were insulin formulations. All of them traced back to one root: factories overseas that got hit by storms, port strikes, export bans, or political friction.

How did we get here?

The shift to foreign manufacturing didn’t happen overnight. In the 1990s, pharmaceutical companies started moving production to China and India because labor was cheaper, regulations looser, and capacity higher. By 2010, over 70% of active pharmaceutical ingredients (APIs) came from just two countries. Today, it’s closer to 85%. For some drugs-like heparin, metformin, or certain steroids-it’s nearly 100%.

Why does this matter? Because APIs aren’t just chemicals. They’re the foundation. If the raw material doesn’t arrive, the pill can’t be made. No matter how many pharmacies you have, if the factory in Shanghai shuts down for three weeks, hospitals run out. And that’s exactly what happened in 2024 when monsoon floods disrupted 12 API plants in Gujarat, India. The result? A 40% drop in metformin supply to the U.S. and Canada. Wait times for diabetics jumped from days to weeks.

The cost of convenience

Companies saved billions by outsourcing. But those savings came with hidden risks. The average lead time for a shipment of APIs from China to the U.S. has grown from 30 days in 2019 to 45 days in 2025. That’s a 50% increase. Why? More customs checks. Fewer cargo ships. Longer port delays. And when you’re depending on a single supplier for a life-saving drug, even a two-week delay can mean patients go without.

And it’s not just delays. Tariffs are now a real factor. The U.S. added 12 new tariff categories between 2024 and 2025, affecting $340 billion in imports-including medical supplies. One medical device maker in Wisconsin told Supply Chain Dive that a single component they sourced from China jumped 280% in price overnight after a new tariff hit. They had to stop production for six weeks while scrambling to find alternatives.

Meanwhile, the cost of keeping inventory has ballooned. Companies that used to run lean-just-in-time delivery-are now holding 15% more stock. That’s $1.2 billion extra in inventory costs across the U.S. pharmaceutical industry in 2025 alone. But even that isn’t enough. When a factory in China closes, you can’t just order more. It takes 18-24 months to set up a new supplier. And most companies still haven’t done it.

Who’s getting hit hardest?

It’s not just big hospitals. Small clinics, rural pharmacies, and independent prescribers are the ones feeling the pinch most. A 2025 survey by the National Foreign Trade Council found that 56% of healthcare providers had to reduce or delay services because they couldn’t get key drugs. In New Zealand, a community pharmacy in Invercargill reported going 11 days without a common heart medication in late 2024. They had to refer patients to Auckland hospitals-adding travel time, cost, and stress.

Small manufacturers are even worse off. They can’t afford to diversify suppliers or stockpile inventory. One mid-sized firm in Hamilton, New Zealand, that makes generic asthma inhalers lost 30% of its supply in 2024 when its sole API supplier in India paused exports due to regulatory changes. They couldn’t afford to switch suppliers. They shut down production for six months.

And then there’s the cybersecurity angle. Over 60% of pharmaceutical manufacturers now use digital systems to track shipments and quality control. But 60% also report serious concerns about cyberattacks. In 2024, a ransomware attack on a German API supplier froze production for 17 days. The ripple effect? Three countries reported shortages of a common antiviral drug.

What’s changing?

Some companies are waking up. IDC forecasts that by the end of 2025, half of all pharmaceutical firms will use a “multi-shoring” model-meaning they’ll make the same drug in two or more countries. One medical device company in the U.S. cut its supply risk by 70% by sourcing components from both India and Mexico. Their on-time delivery rate jumped to 99.2%.

Nearshoring is gaining traction. Mexico now supplies 18% of U.S. pharmaceutical imports, up from 8% in 2019. Transportation costs are 30-40% lower than shipping from Asia. Lead times? Under 10 days. And with the renegotiated USMCA in effect since early 2025, regulatory alignment is smoother than ever. One New Zealand firm that started making insulin pens in Monterrey last year cut its supply delay from 45 days to 12.

Then there’s automation. Microfactories-small, highly automated production units-are being tested in Canada and Australia. They can produce small batches of drugs in under 72 hours. One pilot in Ontario made 50,000 doses of an emergency antibiotic in four days after a supply chain alert. It’s not cheap-automation costs 40% more upfront-but for life-critical drugs, that’s now seen as a necessary investment.

The road ahead

There’s no magic fix. You can’t just move everything home. Labor costs in the U.S. and EU are 4.8 times higher than in China. Building new factories takes years. And the world still needs affordable drugs.

But the old model is broken. Relying on one country for 80% of your medicine is like putting all your eggs in one basket-and then leaving that basket on a busy highway.

The smartest path forward isn’t about going back. It’s about spreading out. Making the same drug in three places. Using AI to predict shortages before they happen. Building digital twins of supply chains so you can simulate disruptions before they hit. And requiring suppliers to carry at least 60 days of buffer stock-not just for profit, but for public safety.

Right now, 78% of pharmaceutical companies are already diversifying suppliers. That’s up from 35% in 2020. Progress is slow, but it’s happening. The question isn’t whether we’ll change. It’s whether we’ll change fast enough to stop the next shortage before it starts.

What can be done?

- Diversify suppliers: Don’t rely on one country. Even two sources cut risk in half.

- Invest in buffer stock: Keep 45-60 days of critical drug inventory. It’s expensive-but cheaper than a public health crisis.

- Support nearshoring: Mexico, Eastern Europe, and Southeast Asia offer viable alternatives with faster logistics.

- Use AI and digital twins: Predict disruptions before they happen. Companies using these tools reduce delays by up to 20%.

- Push for policy change: Governments need to incentivize domestic API production and create strategic stockpiles for essential medicines.

Why are so many drugs made in China and India?

China and India dominate because they have large-scale manufacturing infrastructure, lower labor costs, and decades of experience producing APIs. They also have fewer regulatory barriers and government subsidies for pharma exports. For decades, this made them the cheapest option. But now, the risks-geopolitical, logistical, and environmental-are outweighing the savings.

Can we just make all drugs at home?

Technically, yes-but it’s not practical. Building a single API plant costs $300-500 million. Labor in the U.S. or EU is over four times more expensive than in Asia. That would make life-saving drugs unaffordable for most patients. The goal isn’t full reshoring-it’s balanced resilience: making key drugs in multiple locations.

Are drug shortages getting worse?

Yes. In 2024, the U.S. FDA recorded 310 drug shortages-the highest in 15 years. New Zealand’s Ministry of Health reported a 42% increase in critical drug delays between 2023 and 2025. The main drivers: climate disruptions, export restrictions, and supply chain bottlenecks. While overall supply chain losses have dropped since 2022, pharmaceutical disruptions are rising because of their extreme dependency on single-source manufacturing.

How do tariffs affect medicine availability?

Tariffs raise the cost of importing APIs and finished drugs. When a tariff hits, manufacturers either absorb the cost (cutting profits) or pass it on (raising prices). Many small firms simply stop importing the affected product. In 2024, over 15 generic drugs vanished from U.S. shelves after new tariffs were applied. The same happened in Canada and Australia.

What’s being done in New Zealand?

New Zealand has started piloting regional partnerships with Australia and Southeast Asia to diversify medicine imports. In 2025, the government funded a $12 million initiative to build a small-scale API production unit in Auckland. It won’t replace imports, but it will serve as a backup for 12 essential medicines. The goal: cut reliance on single-source suppliers by 30% over five years.

Drug shortages aren’t accidents. They’re the result of decisions made over decades to prioritize cost over control. The next time you fill a prescription, ask: where did this come from? And what happens if it never arrives?

Ernie Simsek

February 12, 2026 AT 22:23Bro this is wild 😅 I filled my insulin script last week and it cost me $120. Last year? $45. And I found out the batch came from a factory in Gujarat that got flooded. 40% drop in supply? Yeah that’s not a statistic - that’s my life right there. 🥲

Joanne Tan

February 14, 2026 AT 17:31i just want to say THANK YOU for writing this. i’m a nurse in rural ohio and we’ve been rationing antibiotics since jan. no one talks about how this hits small clinics. we’re not big hospitals with 6 month buffers. we’re one shipment away from panic. 🙏

Stacie Willhite

February 16, 2026 AT 11:53My dad’s on metformin. When he couldn’t get it for 3 weeks last year, his sugar went haywire. We ended up driving 90 miles to a pharmacy in Madison. He cried in the car. This isn’t about economics. It’s about people. I’m so glad someone’s finally putting a face on this.

Rob Turner

February 18, 2026 AT 07:37It’s fascinating how we’ve optimized for efficiency at the cost of resilience. In the UK, we’ve seen similar patterns with antibiotics. The irony? The very systems that made drugs cheaper now make them unobtainable. We’ve forgotten that supply chains aren’t just logistics - they’re lifelines. And you don’t design a lifeline like a stock portfolio. 🤔

Gabriella Adams

February 19, 2026 AT 07:27Let me be clear: this isn’t a political issue. It’s a biological one. The human body doesn’t care if your API comes from China, Mexico, or Mars. It just needs the medicine. We’ve turned healthcare into a cost-center instead of a public good. And now we’re paying with lives. The math is simple: 1 person without insulin = 1 tragedy. Multiply that by thousands. We’re not just behind - we’re in freefall.

Steve DESTIVELLE

February 20, 2026 AT 13:28you know what the real problem is no one wants to admit it we built a world where everything is outsourced because we got lazy and greedy and now we are reaping what we sowed the entire system is built on a house of cards and when one card falls everything collapses and yes india and china are convenient but so is sleeping with a gun to your head you think you are safe until the trigger gets pulled

Stephon Devereux

February 22, 2026 AT 07:40Here’s the thing nobody’s saying - automation isn’t the future, it’s the *only* future. Microfactories can make a batch of epinephrine in 72 hours. That’s not innovation. That’s survival. We’re not talking about making more money. We’re talking about not letting a diabetic kid die because a monsoon hit a factory 8,000 miles away. We need to fund this like it’s NASA. Because it is.

steve sunio

February 23, 2026 AT 21:55why do americans act like they invented medicine. china and india make 80% of the world's drugs because they actually know how to make them. you want to move production to usa? good luck paying $500 for a pill. also stop crying about tariffs - you made this bed

athmaja biju

February 25, 2026 AT 09:56INDIA AND CHINA HAVE BEEN MAKING DRUGS FOR CENTURIES. YOU THINK THE WEST IS SOMEHOW BETTER? WE HAVE THE SKILLS THE WORK ETHIC THE SCIENCE. YOU WANT TO BLAME US FOR BEING EFFICIENT? YOU WANT TO BLAME US FOR BEING SMART? THEN YOU ARE THE PROBLEM. STOP BEING A WHINING COWARD AND BUILD YOUR OWN FACTORIES IF YOU CAN

Robert Petersen

February 25, 2026 AT 17:51Hey - I work in supply chain logistics for a mid-sized pharma firm. We just switched 3 critical APIs from China to Mexico. Lead time dropped from 45 days to 11. Costs? Up 12%, but reliability? Up 90%. It’s not perfect, but it’s working. The change is happening. We’re not giving up. We’re adapting. And if you’re a small clinic? Reach out. We’ll help you find alternatives. This isn’t hopeless. It’s a puzzle. And we’re solving it.